The Great Indian Consolidation 🤝

Deep dive into the M&A frenzy FMCG space and future predictions in D2C.

Going for 200 crores one! ☝️

Going for 200 crores two! ✌️

Going for 200 crores three! 👌

And the D2C darling Bewakoof goes to Aditya Birla Group! ✅

Bewakoof’s Facebook status: “Feeling purchased with 7 others” 😅

Haha! It wasn’t exactly a bidding round but fashion apparel brand Bewakoof was recently acquired by Aditya Birla’s house of brand TMRW along with 7 other D2C brands like Berrylush, Nobero, etc.

In this edition, we will discuss why are FMCG giants like Unilever, Nestle, P&G, and others are on an acquisition spree and we’ll take a look at some interesting M&A trends in the retail space. So without further ado, let's get started!

Before we get started ✋

We’ve been surprised and gratified by the number of people who have responded to our efforts. We started this newsletter with only one goal: helping D2C founders & operators succeed in their businesses while making valuable content accessible to everyone. We hope that you have found our newsletter to be useful, and we look forward to continuing the conversation. If there is anything in particular you would like us to write more about, please let us know.

Also, if you're here for the first time and someone who would like to stay updated with the latest news updates from the world of D2C, please consider subscribing :)

Back to our story 🧑💻

India’s D2C market is projected to reach a whopping $100 billion in value by 2025. Yep, you read that right - $100 billion! That's a whole lot of shampoo, soap, and snacks being sold directly to consumers online!

It's no surprise that FMCG giants have started taking notice and are now rolling up their sleeves to dominate this growing market by acquiring young D2C brands. Over the past few months, several acquisitions in this space have made headlines.

Let's take a look at some of them:

HUL 🤝 Oziva

Hindustan Unilever Limited (HUL) recently made its entry into the health and wellbeing segment by acquiring a majority stake in Zywie Ventures Private Ltd, which owns the brand OZiva, for a whopping INR 264 crore. In addition, the company has also purchased significant stakes in Wellbeing Nutrition, a leading player in the growing nutraceutical category in India. With these strategic acquisitions, HUL is making its mark in the health and wellness space and expanding its portfolio to meet the changing needs of consumers.

Marico 🤝 Beardo

Beardo, one of India's earliest and most successful D2C exits, was acquired by Harsh Mariwala's FMCG conglomerate Marico in 2020. Since then, Marico has been on the lookout for new brands to add to its portfolio, and their latest acquisition is the leading D2C snack brand, True Elements. With this addition, Marico continues to expand its presence in the D2C space and strengthen its position in the FMCG industry.

ITC 🤝 Yoga Bar

FMCG giant ITC is all set to acquire a 100 percent stake in Bengaluru-based healthy snack company Yoga Bar, as part of its ‘ITC Next’ strategy that focuses on building a portfolio of products serving evolving consumer needs. ITC's acquisition of Yoga Bar shows that they're committed to keeping up with the changing tastes of consumers.

In addition to these outright acquisitions, we’ve also seen strategic investments by FMCG giants in promising D2C startups, as they look to diversify their portfolios and stay ahead of the competition. A familiar example would be Bombay Shaving Company raising investment from consumer goods behemoths like Reckitt Benckiser & Colgate Palmolive.

Why are legacy brands acquiring D2C brands?

The M&A trend has been gaining momentum lately in the D2C space. Remember Thrasio? (maybe we’ll talk about it in detail in our next edition).

But why are large FMCG giants jumping on the bandwagon? Let's understand the reasons behind the consolidation wave.

There are three primary reasons for it:

Access to new markets and customers 📈

D2C startups often have a strong online presence and a loyal following among younger consumers who prefer to shop online. For FMCG giants & legacy brands, acquiring these startups can provide a fast-track to new markets and a younger customer base that they may not have been able to reach otherwise.

Innovation and agility 🤌✨

D2C startups are known for their ability to innovate quickly and respond to changing consumer preferences. By acquiring these startups, these legacy retail brands can tap into this innovation and agility, and use it to develop new products and improve existing ones.

Saving cost (Buy vs Build) 💸

By acquiring a D2C startup, FMCG giants can avoid the time and expense of building a brand from scratch. They can also benefit from the startup's existing supply chain and distribution channels, which can lead to cost savings and operational efficiencies.

What does this mean for startups & consumers?

On the one hand, it can be seen as a validation of the startups' business models and a way to scale up quickly with the backing of a big brand.

On the other hand, some critics argue that these acquisitions could stifle innovation and creativity, and lead to a homogenization of products and services. There's also the concern that small players may be squeezed out of the market, as big brands with deep pockets can afford to spend more on advertising, promotions, and discounts.

But one thing is for sure ⬇️

Power law will continue to prevail ☝

And we’re likely to witness more consolidations in the D2C space over the next several months as competition continues to heat up.

“You either die a bootstrapped company or live long enough to get acquired’

Scared already? 😨😅

While consolidation looks inevitable for the new insurgent brands because of the challenges ahead, India’s D2C story is far from over! 🙅♂️

There will always be room for innovative and disruptive startups that can find a unique niche and carve out a profitable business. Startups will continue to co-exist with the established players and find ways to differentiate themselves to survive and thrive.

Overall, the future of DTC looks promising, and we can't wait to see what exciting developments the industry has in store for us 🤗

That’s it for now folks!

Hit that 💛 if you liked today’s issue.

You can forward this email or share it on social media by clicking the button below.

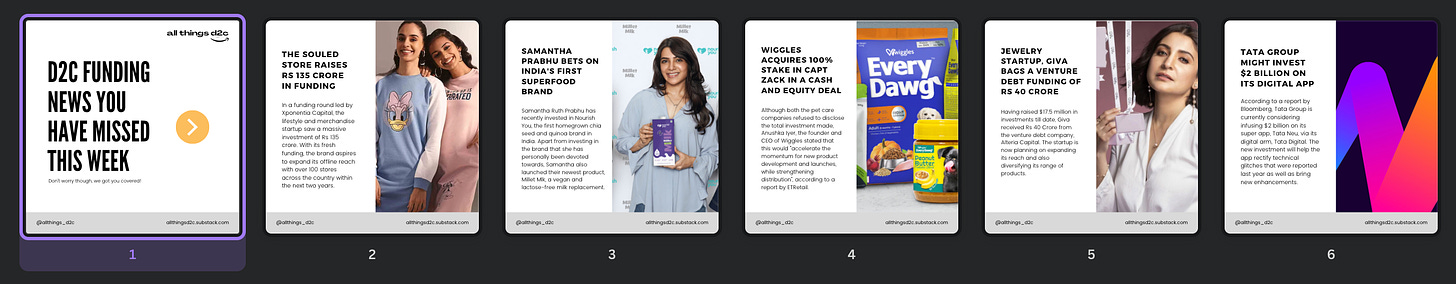

PS: In case you’ve missed our recent updates from LinkedIn / Twitter ⬇️

Until next time 👋